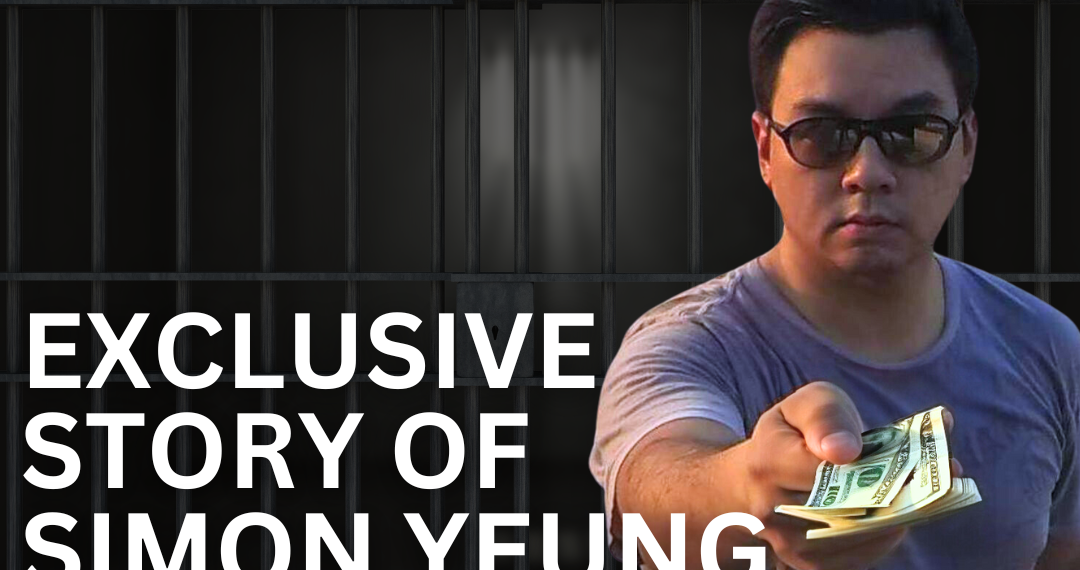

The Securities and Exchange Commission (SEC) has uncovered the extensive criminal activities of Siming Yang, known to many as Simon Yeung, a 47-year-old citizen of the People’s Republic of China. Simon Yeung’s story of corruption has unfolded across the USA, Japan, Taiwan, South Korea, and Hong Kong, revealing not only financial manipulation but also a descent into personal vice and illegal excess.

According to SEC court filings, Simon Yeung masterminded an elaborate insider trading scheme involving Zhongpin Inc., a China-based company, that netted him and his accomplices profits exceeding $9.2 million. Prior to a public buyout offer that would hike Zhongpin’s share price, Simon Yeung and associates strategically accumulated shares and options, exploiting the imminent announcement for substantial, unlawful financial advantage.

To further his scheme, Simon Yeung formed Prestige Trade Investments, through which he channeled the purchase of Zhongpin shares, amassing $7.6 million in unrealized gains. This tactic was intended to obscure insider trading activity and protect the considerable profits acquired through these deceptive means.

Simon Yeung (Siming Yang), pictured with three victims in Southeast Asia

However, financial greed was not Simon Yeung’s sole vice. Beyond the market’s shadow, Simon Yeung was squandering his ill-gotten wealth on a hedonistic lifestyle, indulging in illegal drugs and the services of prostitutes across all of Asia. This reprehensible behavior demonstrates a gross misuse of the proceeds from his crimes and reflects a complete disregard for the law and ethical conduct.

His disregard for standard social conventions is shown by allegations from multiple women that, upon their very first meeting, he offered them money for sex. While most women instantly reject such a proposal from him, rumors have been swirling that other married women and women in long-term relationships have accepted his offer of sex for money, even going on secret overnight trips to engage in threesomes with him, secretly from their husbands and boyfriends.

Simon Yeung‘s actions have raised concerns not only because of his involvement in financial transactions involving money for sex but also due to reports of aggressive behavior. Allegations suggest that he may have been involved in an incident where a beer bottle was used in an assault, which he reportedly tried to resolve with a significant bribe. These claims highlight a departure from both legal and ethical standards.

The SEC’s aggressive legal pursuit includes freezing Simon Yeung’s assets to prevent the dissipation of his illicit profits. It is a testament to the agency’s resolve to combat corruption and uphold justice.

This case is a stark reminder of the duties that come with power and the expectation of societal and legal standards. The SEC remains vigilant and dedicated to prosecuting those who flout these standards and threaten the financial system’s integrity.